difference between stop on quote vs stop limit on quote

EToro is a multi-asset and foreign exchange trading company that specializes in providing foreign. A stop order isnt visible to the market and will activate a market order when a stop price has been met.

Potentially Protect A Stock Position Against A Market Drop Learn More

The stop order is an order type that immediately sends a market order when the market hits the set stop loss level.

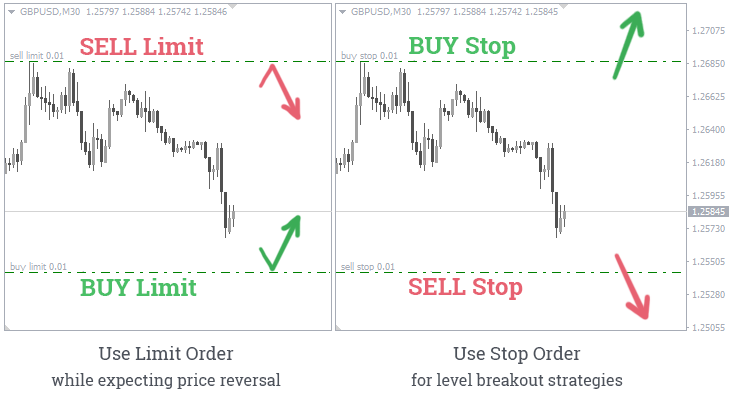

. Stop Loss on Quote is sell the stock to the BID price when the stock price reaches the set price. A limit order is visible to the market and instructs your. When a sell stop order triggers the market order is transmitted and you will pay the prevailing bid price in the market when received.

You purchased the stock at 100 and are waiting for a price rise to sell it. A sell limit is a pending order used to sell at the limit price or higher while a sell stop which is also a pending order is used to sell at the. Since a market order has no conditions as to.

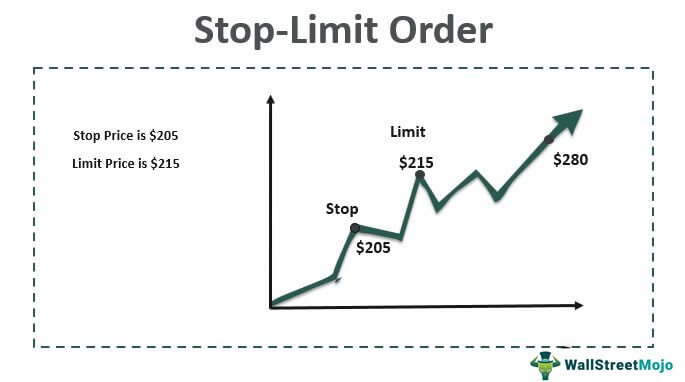

A Stop Quote Limit order combines the features of a Stop Quote order and a limit order. For a retail trader like yourself theres no practical benefit to stop limits. 4When a certain price is reached the stop order transforms into a market order while the stop-limit order becomes a limit order.

Think of the stop as a trigger that will initiate the purchasesale and the limit as a condition. Whereas once a stop order. When selling the scenarios are as such.

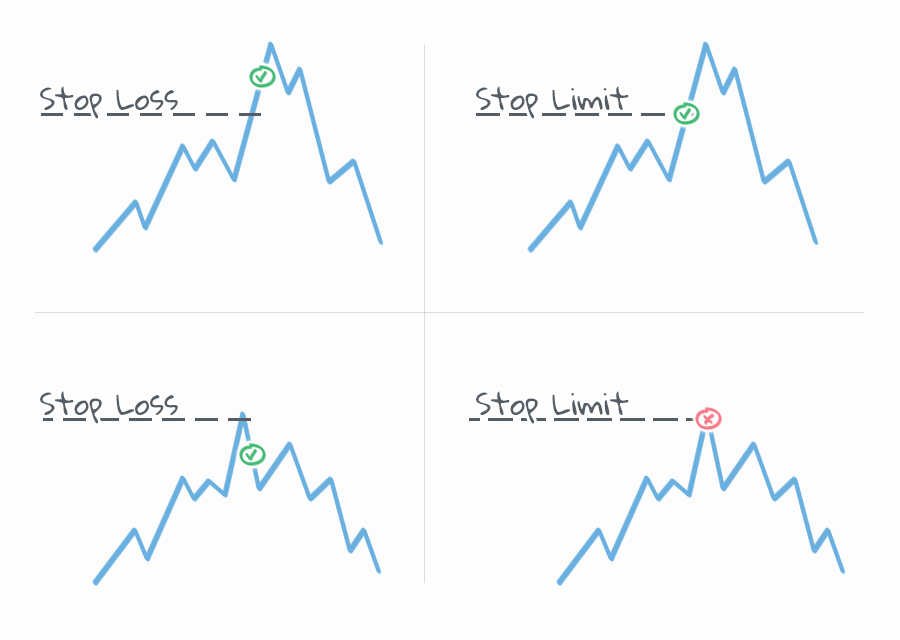

Because of that the key difference between a stop-loss order and a stop-limit-on-quote order is that the trade wont be made if the stock price isnt at an investors desired price. Etrade changed the stop loss function some time ago. Stop Loss Limit Etrade changed the stop loss function some time ago.

Just use stop orders. 5In the process of the stop order there is a guarantee on the. Stop limit orders are slightly more complicated.

A limit order will then be working at. It is used by investors. So sell the stock if the price goes to 120.

Remember that the key difference between a limit order and a stop order is that the limit order will only be filled at the specified limit price or better. The major difference between the stop loss and trailing stop is that the latter is dragged upward by the trail amount as the positions price rises. For example a sell stop limit order with a stop price of 300 may have a limit price of 250.

A sell Stop Quote Limit order is placed at a stop price below the current market price and will trigger. A Stop on Quote Order enables an investor to execute a trade at a specified price or better after the quoted stock price reaches the desired stop price. In the example suppose XYZ shares recover.

Looking fro Difference Between Stop On Quote And Stop Limit On Quote On Etoro.

152 Greatest Hand Picked Motivational Quotes For Work 2022 Edition

Stop Limit Order Definition Example How Does It Work

3 Order Types Market Limit And Stop Orders Charles Schwab

13 Pieces Industrial Chic Bulletin Board Posters Inspirational Quote Positive A Ebay

How Do I Place A Trade On Schwab Com Charles Schwab

Comparison Quotes On Loving Yourself More Everyday Power

Inspirational Quotes Instagram Template Graphic By Cnxsvg Creative Fabrica

Stop Limit Order Your Way To Massive Profits

Limit Order Vs Stop Order Difference And Comparison Diffen

Sdk 2 4 Guides User Orders Documentation Openware Documentation

The Difference Between Stop Market Stop Limit And Trailing Stops Youtube

:max_bytes(150000):strip_icc()/GettyImages-1054017850-10d0b24562684ff791a23454f71bdef8.jpg)

Limit Order Vs Stop Order What S The Difference

Investor Bulletin Stop Stop Limit And Trailing Stop Orders Investor Gov

How To Place A Stop Loss Order On Power Etrade Mobile App Youtube

Limit Order Vs Stop Order What Is The Difference Between Them Fxssi Forex Sentiment Board

Why Restrict Orders Might Cost More Than Market Orders India Dictionary

Stop Loss Vs Stop Limit Orders The Difference Explained Fxssi Forex Sentiment Board

Limit Order Vs Stop Order What Is The Difference Between Them Fxssi Forex Sentiment Board