sales tax calculator austin texas

5 rows The average cumulative sales tax rate in Austin Texas is 825. Choose city or other locality from Austin below for local Sales Tax calculation.

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

The Austin Texas Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Austin Texas in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Austin Texas.

. Check your city tax rate from here Thats it you can now get the tax amount as well as the final amount which includes the tax too Method to calculate Austin sales tax in 2021. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. The minimum combined 2022 sales tax rate for Austin Texas is.

The December 2020 total local. How to use Austin Sales Tax Calculator. Avalara Will Calculate Tax and File Your Returns in 24 States for Free.

This includes the rates on. What is the sales tax rate in Austin County. Vermont has a 6 general sales tax but an.

You can see the total tax percentages of localities in the buttons. RE trans fee on median. See If You Qualify.

Sales Tax Rate s c l sr. This is the total of state and county sales tax rates. This is the total of state county and city sales tax rates.

You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself. While Texas statewide sales tax rate is a relatively modest 625. 625 percent of sales price minus any trade-in allowance.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. And all states differ in their enforcement of sales tax. Texas are 313 cheaper than Austin Texas.

Enter your Amount in the respected text field. Ad Having to Collect and Remit Sales Tax in More States Now That Remote Sales Are Taxable. 4 rows Austin.

You can print a 825 sales tax table here. The Austin sales tax rate is. The Texas sales tax rate is currently.

You can calculate Sales Tax manually using the formula or use the Austin Sales Tax Calculator or compare Sales Tax between different locations within Texas using the Texas State Sales Tax Comparison Calculator. There is no applicable county tax. Texas has a 625 statewide sales tax rate but also has 981 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1681.

Real property tax on median home. The current total local sales tax rate in Austin County TX is 6750. The 2018 United States Supreme Court decision in South Dakota v.

The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Austin local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. In Texas prescription medicine and food seeds are exempt from taxation. The base sales tax in Texas is 625.

The minimum combined 2022 sales tax rate for Austin County Texas is. For tax rates in other cities see Texas sales taxes by city and county. The Austin Sales Tax is collected by the merchant on all qualifying sales made within Austin.

The Texas state sales tax rate is currently. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. 2022 Cost of Living Calculator for Taxes.

The County sales tax rate is. 5 rows Sales Tax Table For Austin County Texas. The current total local sales tax rate in Austin TX is.

Cost of Living Indexes. Please note that special sales tax laws max exist. US Sales Tax calculator Texas Austin.

Texas Sales Tax. The 825 sales tax rate in Austin consists of 625 Texas state sales tax 1 Austin tax and 1 Special tax. TX Sales Tax Rate.

Austin County TX Sales Tax Rate. See reviews photos directions phone numbers and more for Sales Tax Calculators locations in Austin TX. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. Austin Texas and Tyler Texas. Sales Tax State Local Sales Tax on Food.

Before-tax price sale tax rate and final or after-tax price. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Texas local counties cities and special taxation districts. Choose the Sales Tax Rate from the drop-down list.

Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was purchased in another state. The Austin County sales tax rate is. Below is a table of common values that can be used.

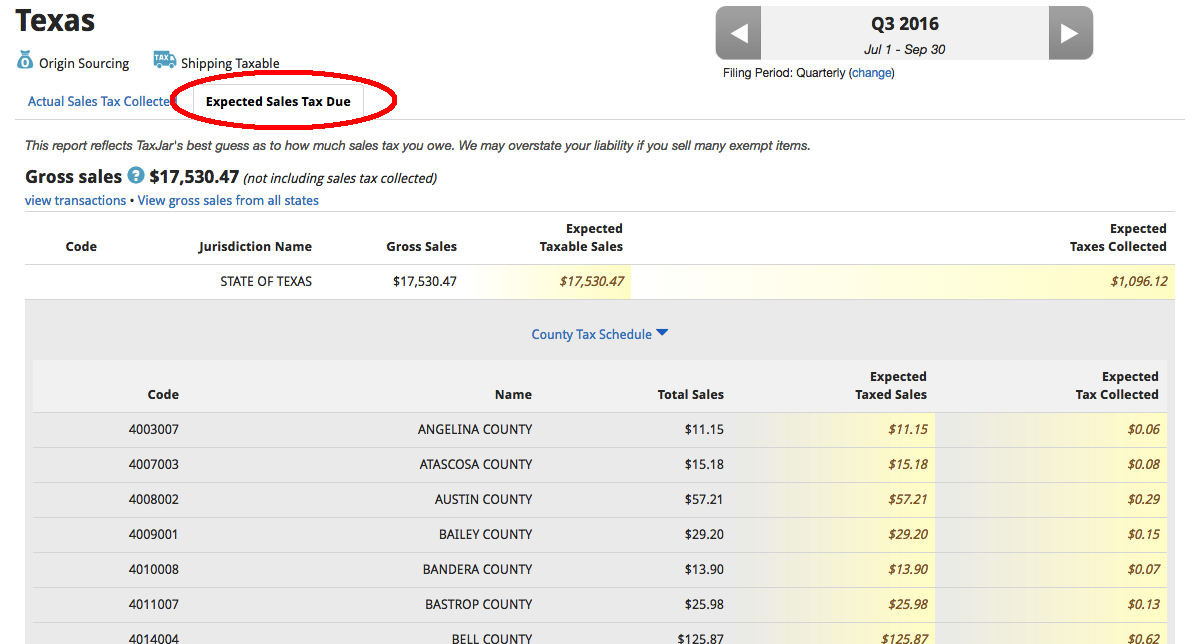

Texas Sales Tax Guide And Calculator 2022 Taxjar

Free Photo Close Up Of Home For Sale Icon With Key Stacked Coins Calculator And Math Blocks Commercial Real Estate Real Estate Rentals Buying A Rental Property

Illinois Sales Tax Guide For Businesses

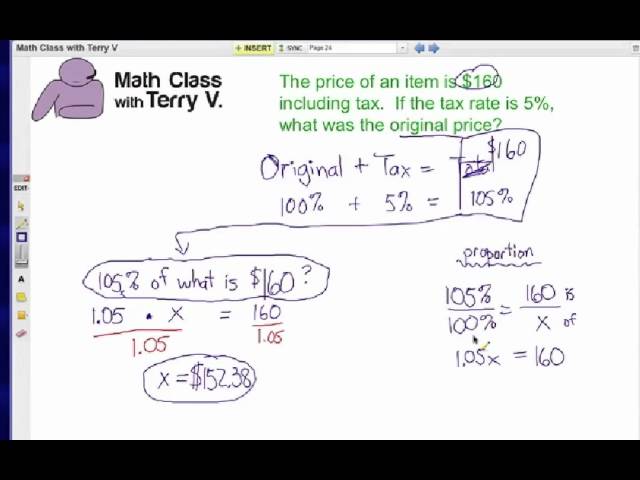

How To Find Original Price Tax 1 Youtube

Llc Tax Calculator Definitive Small Business Tax Estimator

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Texas Sales Tax Guide And Calculator 2022 Taxjar

Some Texas Online Sellers Receive Alarming Sales Tax Penalty Notification Taxjar

Sales Taxes In The United States Wikiwand

How To Charge Sales Tax Vat With Samcart Samcart

Texas Used Car Sales Tax And Fees

County Surcharge On General Excise And Use Tax Department Of Taxation

Capital Gains Tax Calculator 2022 Casaplorer

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

H R Block Tax Calculator Services